pros and cons list carbon tax

This would result in tax revenue of 670 billion. The Pros and Cons of Taxing Climate Change.

Niner Air 9 Carbon Pricing Photos 1899 For Frame Hardtail Mountain Bike Bike Design Urban Bicycle

The tax rate on carbon products should be attaches to objective CO2 tonnage contributed to the atmosphere.

. At a high level the primary advantage is the carbon tax will force companies to find alternative methods in their manufacturing processes by levying a tax that increases their cost. Reuters - The voluntary carbon offset credit market has the potential to play a major. Carbon tax would help determine the taxs ultimate impact on the economy.

Using the Revenues to Reduce Deficits Would Decrease. Most new PHEVs for sale remain eligible for a federal tax rebate of up to. CBO analyzed three possibilities.

Adele Morris proposes a carbon tax as a new source of revenue that could also help address climate change. Carbon offset credits and their pros and cons. Unfortunately this would also create a major disadvantage as the carbon tax will most likely hurt.

The carbon tax creates an artificial economic market that isnt always sustainable. The system needs to be employed by law similar to other sin taxes on alcohol tobaccos and even sales taxes. However some differences exist.

Don Fullerton the Nannerl Keohane Distinguished Visiting Professor for Spring 2015. BY RP Siegel. CO2 taxes often apply when triggering thresholds get reached through mining production or fabrications activities.

Sustainable Living Taking Action from BANK OF THE WEST The Pros and Cons of Carbon Offsetting. As a leading sustainable brandand a company. A climate change economist discusses effectiveness of a carbon tax.

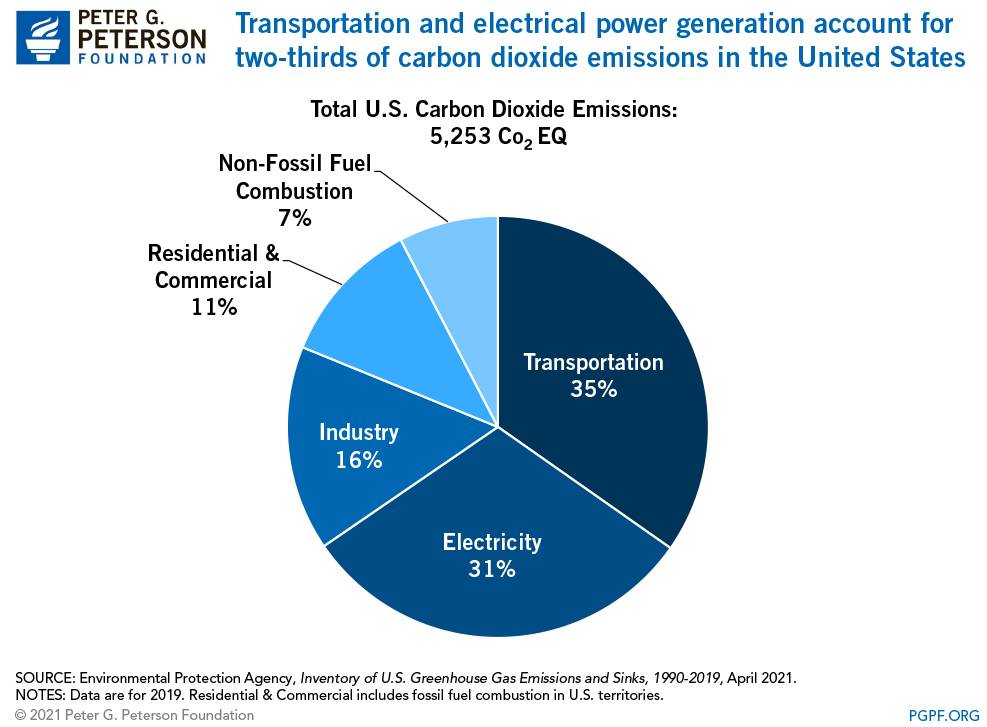

A carbon tax increases energy costs in proportion to the carbon content of the source of energy. This can be implemented either through a carbon tax known. Higher carbon tax rates cause larger changes in energy prices.

In relation to the US Hansen argues that we could set a carbon tax at US115 per ton of CO2. On account of the different carbon-intensity of fuels price impacts are most significant for energy produced with coal then petroleum then natural gas. Many of the new carbon tax proposals use an emissions trading system as a primary form of income generation.

The carbon tax is the most equitable method for carbon use to pay for its pollution. Some uses of those revenues could substantially offset the total economic costs result-ing from the tax itself whereas other uses would not. British Columbia has taxed gasoline fuel and natural gas for a decade.

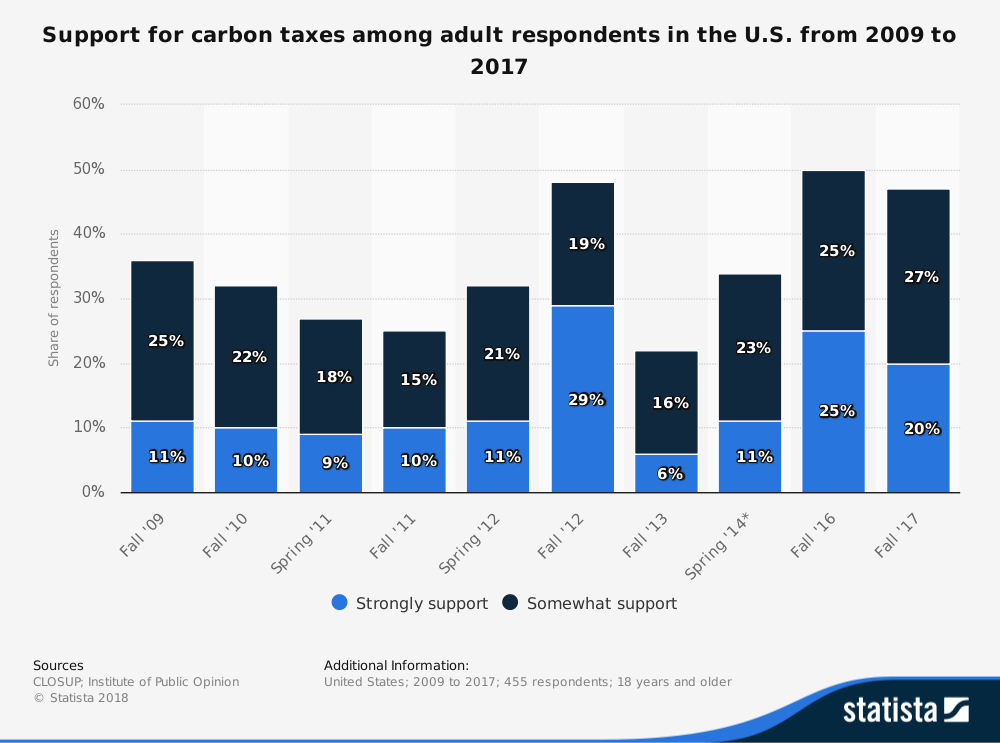

There are quite a few pros and cons that need to be discussed. He suggests that this should be given 100 as a dividend to the general public stating that the family with carbon footprint less than average makes money their dividend exceeds their tax. Using the carbon tax revenues to reduce deficits says CBO would decrease the taxs total costs to the.

By Shadia Nasralla Susanna Twidale. She suggests that a carbon tax would reduce the buildup of greenhouse gasses replace. Get that hefty tax break.

Carbon taxes and cap-and-trade schemes are two ways to put a price on carbon pollution each with its own pros and cons Skip to main. Featuring 32 riders performing jaw-dropping tricks as they shred through rugged terrain across North America and Europe Burtons recent film One World is an epic celebration of snowboarding. PHEV owners can use either fuel source based on which is cheapest and available at the time.

Solar panels wind turbines nuclear power plants and electric cars are no longer enough to mitigate the risks posed by human. The carbon tax started at 10 per tonne in 2008 rose to 30 per. It is easier and quicker for governments to implement.

A carbon tax also has one key advantage. A carbon tax can be very simple. Both cap-and-trade programs and carbon taxes can work well as long as they are designed to provide a strong economic signal to switch to cleaner energy.

Niner Air 9 Carbon Fiber Hardtail Bike Hardtail Mountain Bike Folding Mountain Bike Mtb Bike Mountain

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Carbon Tax Pros And Cons Economics Help

What Is A Carbon Tax How Would It Affect The Economy

Carbon Tax Pros And Cons Economics Help

Go Ahead And Give This A Read 50 Reasons To Date A Bartender Http Cocktailsandshots Tumblr Com Post 163717765318 Utm Campaign Cr Bartender Mortgage Dating

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

A List Of Different Sustainable Farming Methods Practices Better Meets Reality Sustainable Farming Farm Crop Farming

What Is Esg Investing And 5 Reasons Why It Is A Bad Idea Financial Freedom Countdown In 2021 Financial Freedom Investing Financial

Carbon Tax Pros And Cons Economics Help

Niner Air 9 Carbon Pricing Photos 1899 For Frame Mountain Bike Reviews Hardtail Mountain Bike Montain Bike

Carbon Tax Pros And Cons Economics Help

I Pinimg Com Originals A0 C8 50 A0c8505d1d8ca67

Carbon Tax Pros And Cons Economics Help

Invoice Design Inspiration Best Examples And Practices Invoice Design Invoice Template Invoice Template Word

Household Battery Storage A Comparison Of Product Price Performance Battery Storage Storage Table Storage